Proud and active ownership

Creating Value Through Active Ownership

Since 1841, Aker has been a driving force in developing robust businesses and knowledge-based industries with a global footprint. Combining industrial competence with capital markets expertise and financial strength, Aker works to benefit shareholders and society. Explore how we create long-term value through a diverse and forward-looking portfolio.

INVESTMENT CASE

Reasons to invest

As an active and proud shareholder in companies with attractive value and dividend potential, Aker’s ownership agenda is to contribute to a positive return for all shareholders.

Proven Track Record

With nearly two decades of strong performance since its relisting in 2004—and roots dating back to 1841—Aker has demonstrated its ability to create long-term value. Our consistent returns, disciplined investment strategy and industrial expertise reflect a track record of resilience and results.

Proud and Active Ownership

Active ownership lies at the heart of Aker’s model. We work closely with our portfolio companies to drive strategic development, operational excellence and long-term value creation. This hands-on approach defines our culture and strengthens our impact—both for shareholders and society.

Commitment to Deliver Value

Aker is committed to delivering attractive returns through a focused portfolio, strong capital discipline and a clear dividend policy. We aim to grow Net Asset Value by at least 10% annually, while distributing 4–6% of NAV in dividends—ensuring that value creation and value sharing go hand in hand.

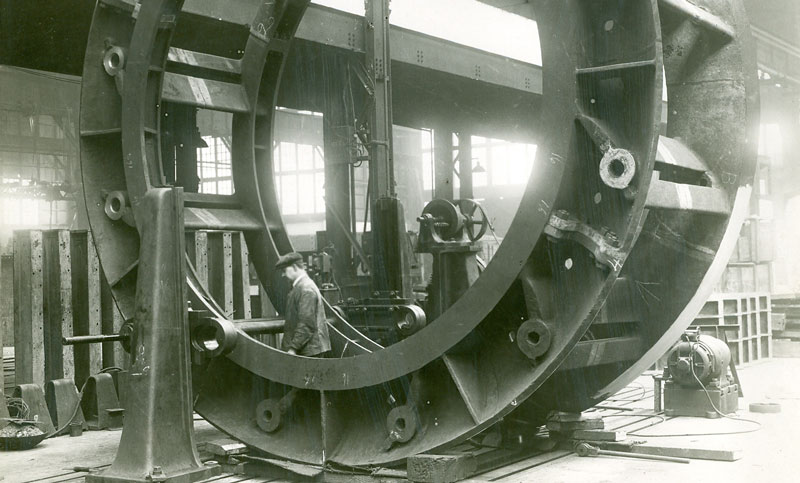

Industrial Legacy Since 1841

Aker’s legacy spans more than 180 years of industrial innovation and development. From shipbuilding to energy, and now to technology and green solutions, our history serves as a foundation for forward-looking growth. We combine deep-rooted expertise with a future-oriented mindset.

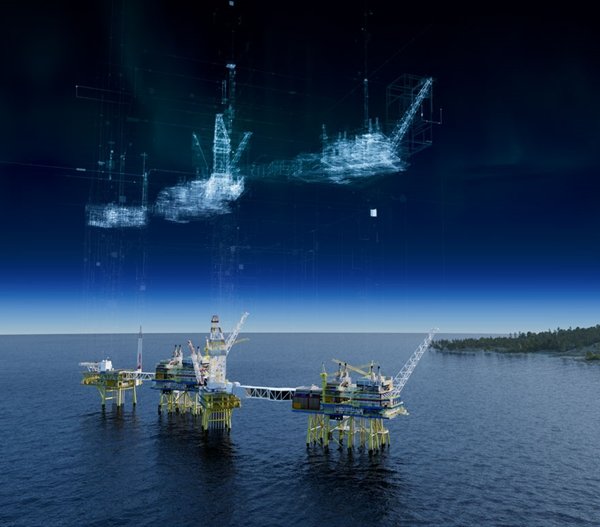

High-Quality Portfolio

Our portfolio includes leading companies across the energy, marine, industrial software and green technologies sectors. Each investment is carefully selected and actively managed to ensure strategic alignment, financial strength, and long-term potential.